Auto loan refinance rates today are crucial for anyone looking to save money on their car loan. Understanding how these rates work and what factors affect them is key to making informed financial decisions.

Understanding Auto Loan Refinance Rates Today

When considering auto loan refinance rates, it’s important to understand how these rates are determined and what factors influence them.

What are Auto Loan Refinance Rates?

Auto loan refinance rates refer to the interest rates charged on a refinanced auto loan. These rates determine how much you will pay in interest over the life of the loan.

How are Auto Loan Refinance Rates Determined?

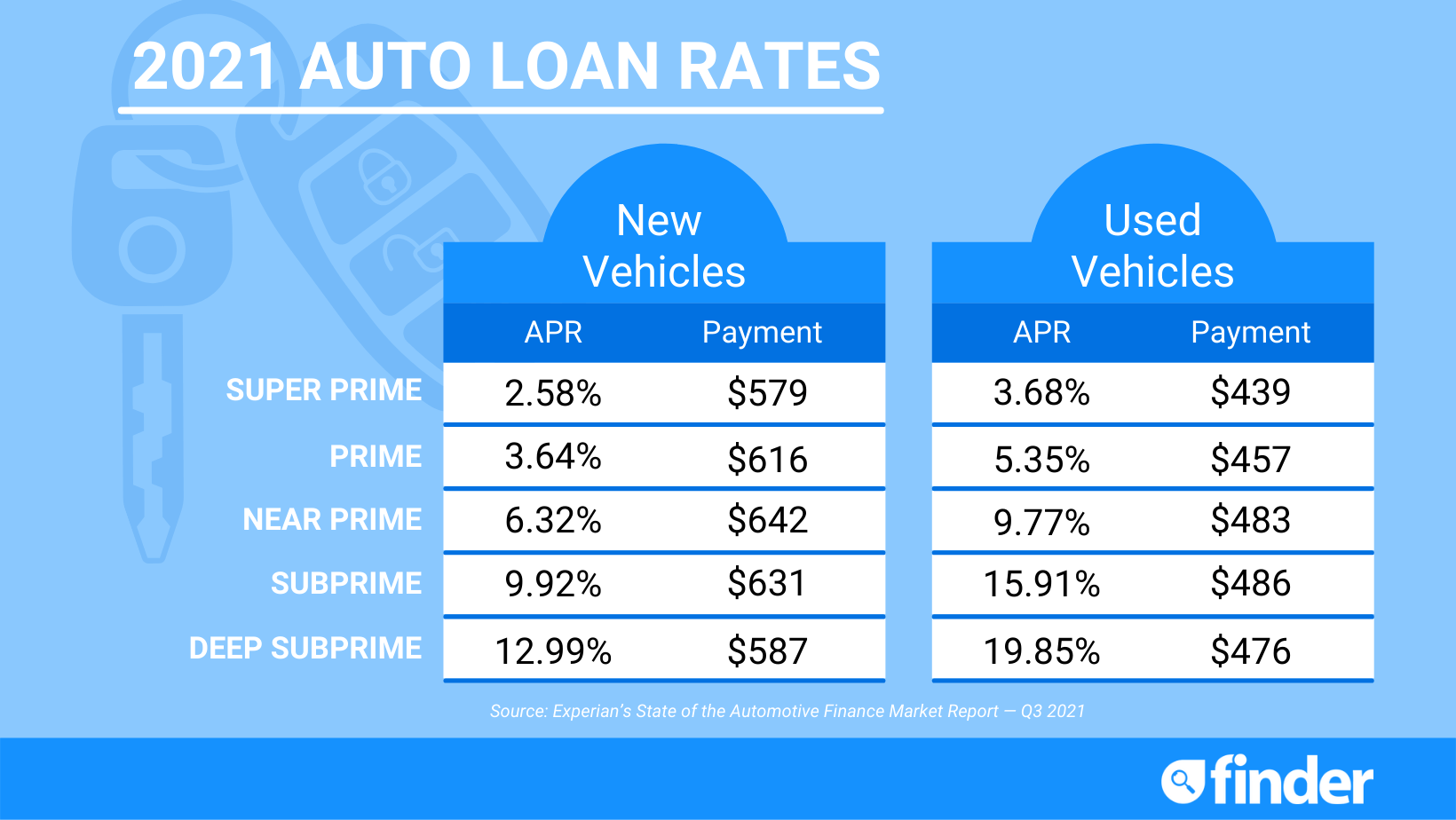

Auto loan refinance rates are influenced by various factors, including the borrower’s credit score, the loan amount, the loan term, and the current economic conditions. Lenders use these factors to assess the risk associated with lending money to a borrower.

Factors that Influence Auto Loan Refinance Rates

- Credit Score: A higher credit score typically results in lower interest rates as it indicates lower risk for the lender.

- Loan Amount: The amount of the loan can impact the interest rate, with larger loans sometimes having higher rates.

- Loan Term: Shorter loan terms usually come with lower interest rates compared to longer terms.

- Current Economic Conditions: Economic factors such as inflation, market rates, and the lender’s cost of funds can also affect auto loan refinance rates.

Benefits of Refinancing Auto Loans

Refinancing auto loans can offer several advantages to borrowers, helping them save money and improve their financial situation.

Potential Savings with New Auto Loan Rates

- Lower Interest Rates: By refinancing your auto loan at a lower interest rate, you can reduce your monthly payments and overall interest costs.

- Shorter Loan Term: Opting for a shorter loan term when refinancing can help you save on interest payments over the life of the loan.

- Improved Credit Score: Refinancing at a lower rate can also help improve your credit score, leading to better future loan terms.

Financial Stability Improvement

- Debt Consolidation: Refinancing your auto loan can also allow you to consolidate other high-interest debts into a single, more manageable monthly payment.

- Cash Flow Improvement: Lowering your monthly auto loan payments through refinancing can free up cash flow for other expenses or savings goals.

- Flexible Terms: Refinancing can provide you with the opportunity to choose more favorable loan terms that align with your financial goals and budget.

Process of Refinancing Auto Loans

When considering refinancing your auto loan, there are specific steps involved in the process that you should be aware of. Understanding these steps can help you navigate the refinancing process smoothly and make informed decisions.

Steps Involved in Refinancing an Auto Loan

- Evaluate Your Current Loan: Begin by reviewing the terms of your current auto loan, including the interest rate, remaining balance, and monthly payments.

- Check Your Credit Score: Your credit score plays a crucial role in determining the interest rate you may qualify for when refinancing. Make sure your credit score is in good shape before applying.

- Research Lenders: Compare rates and terms from various lenders to find the best refinancing option that suits your needs.

- Apply for Refinancing: Submit an application with the chosen lender, providing all necessary documentation and information.

- Review Loan Offers: Once you receive offers from lenders, carefully review the terms, including the interest rate, loan term, and any fees involved.

- Accept the Offer: If you find a suitable offer, accept it, and proceed with the refinancing process.

- Pay Off Your Current Loan: The new lender will pay off your existing auto loan, and you will start making payments to the new lender according to the agreed-upon terms.

Documentation Required for the Refinancing Process

- Proof of income (pay stubs, tax returns)

- Vehicle information (make, model, VIN)

- Current auto loan details

- Personal identification (driver’s license, social security number)

- Proof of insurance

Timeline and Typical Duration of Refinancing an Auto Loan

Refinancing an auto loan can typically take anywhere from a few days to a few weeks, depending on the lender and the complexity of your application. The process involves reviewing your application, verifying information, and finalizing the loan terms before funding.

Factors to Consider Before Refinancing

When considering refinancing an auto loan, there are several important factors to keep in mind to ensure you make the best decision for your financial situation.

Credit Score Impact

Your credit score plays a crucial role in determining the interest rates you may be offered when refinancing your auto loan. A higher credit score generally leads to better refinancing rates, while a lower credit score may result in higher rates or potential rejection of your application. It is essential to check your credit score before applying for refinancing and take steps to improve it if necessary.

Importance of Comparing Offers

It is vital to shop around and compare multiple loan offers from different lenders before committing to refinancing your auto loan. By comparing offers, you can ensure that you are getting the best possible rates and terms available to you. Different lenders may have varying interest rates, fees, and repayment terms, so exploring your options can help you save money in the long run.

Current Trends in Auto Loan Refinance Rates

Auto loan refinance rates are subject to fluctuations based on various factors in the market. Understanding the current trends in these rates can help borrowers make informed decisions when considering refinancing their auto loans.

Market Influences on Auto Loan Refinance Rates

Auto loan refinance rates are influenced by economic factors such as the Federal Reserve’s interest rates, inflation, and overall market conditions. When the Federal Reserve lowers interest rates, it can lead to a decrease in auto loan refinance rates, making it a favorable time for borrowers to refinance. Conversely, if inflation is high, lenders may increase refinance rates to offset the decrease in purchasing power.

Recent Changes in Refinance Rates

In recent times, there has been a trend of fluctuating auto loan refinance rates due to the impact of the COVID-19 pandemic on the economy. Initially, rates dropped significantly as a response to the economic uncertainty caused by the pandemic. However, as the economy started to recover, refinance rates began to rise gradually. It is essential for borrowers to stay updated on these changes to take advantage of favorable rates when considering refinancing their auto loans.

Finding the Best Auto Loan Refinance Rates Today

When looking for the best auto loan refinance rates today, it’s essential to compare different lenders and their offerings to ensure you get the most favorable terms. Here are some tips to help you find the best rates and save money on your auto loan refinance:

Compare Different Lenders and Their Offerings

- Research and compare interest rates, fees, and terms offered by various lenders.

- Check with banks, credit unions, online lenders, and even your current auto loan provider for refinance options.

- Consider both traditional and online lenders to find the best rates and terms that suit your financial situation.

Utilize Online Tools or Resources

- Use online comparison tools and calculators to compare auto loan refinance rates from different lenders.

- Check websites that offer rate comparisons and customer reviews to help you make an informed decision.

- Consider using online platforms that connect you with multiple lenders to get personalized rate quotes easily.

Risks Associated with Auto Loan Refinancing

When considering auto loan refinancing, it is essential to be aware of the potential risks involved. While refinancing can offer benefits such as lower interest rates and monthly payments, there are also drawbacks that borrowers should consider.

Refinancing may not be a suitable option in the following situations:

When Refinancing May Not Be a Suitable Option

- If the remaining loan term is short: Refinancing a car loan with only a few payments left may not result in significant savings and could extend the overall repayment period.

- If your credit score has decreased: If your credit score has dropped since you initially took out the loan, you may not qualify for better terms when refinancing.

- If prepayment penalties apply: Some auto loans come with prepayment penalties, which could outweigh any potential savings from refinancing.

To mitigate risks when considering auto loan refinance, it is essential to:

Mitigating Risks when Considering Refinance

- Review your current loan terms: Understand the terms of your existing auto loan, including any fees, penalties, and the remaining balance.

- Compare offers from multiple lenders: Obtain quotes from different lenders to ensure you are getting the best possible rate and terms.

- Consider the total cost: Look beyond the monthly payment and consider the total cost of the new loan, including any fees or charges.

- Avoid extending the loan term: While a longer loan term may lower your monthly payments, it can result in paying more interest over time.

Impact of Interest Rates on Auto Loan Refinance

Interest rates play a crucial role in determining the overall cost of an auto loan refinance. Fluctuating interest rates can have a significant impact on borrowers’ monthly payments and the total amount paid over the life of the loan. Let’s delve into how changing interest rates can affect auto loan refinance decisions and explore strategies for navigating these fluctuations effectively.

Effect on Monthly Payments

When interest rates decrease, borrowers who refinance their auto loans at a lower rate can potentially see a reduction in their monthly payments. This means more money saved each month, which can be redirected towards other financial goals or expenses. On the other hand, if interest rates increase, borrowers may experience higher monthly payments, leading to increased costs over time.

Strategies for Navigating Interest Rate Changes

- Monitor Interest Rate Trends: Stay informed about the current interest rate environment and be prepared to act when rates are favorable for refinancing.

- Compare Offers: Shop around and compare offers from different lenders to secure the best possible rate for your auto loan refinance.

- Consider Timing: Timing is key when it comes to refinancing. Waiting for a dip in interest rates or taking advantage of promotional offers can result in substantial savings.

- Consult with a Financial Advisor: Seeking guidance from a financial advisor can help you make informed decisions about when to refinance based on your individual financial situation and goals.

Tips for Negotiating Auto Loan Refinance Rates

When it comes to negotiating auto loan refinance rates, there are several strategies that can help you secure better deals and terms. Understanding how to leverage your position and approach lenders can make a significant difference in the rates you are offered.

Effective Negotiation Strategies

- Do Your Research: Before negotiating with lenders, make sure you have a good understanding of current market rates and offers. This knowledge will give you leverage during the negotiation process.

- Highlight Your Creditworthiness: Emphasize your strong credit score and financial stability to lenders. This can help you negotiate for lower interest rates and better terms.

- Shop Around: Don’t settle for the first offer you receive. Take the time to compare offers from multiple lenders and use them as leverage to negotiate better rates.

- Consider Using a Co-Signer: If you have a co-signer with a better credit score, you may be able to secure more favorable refinance rates. This can be a powerful negotiation tool.

Importance of Leverage in Negotiations

- Leverage Your Credit Score: A higher credit score gives you more negotiating power as lenders are more likely to offer better rates to borrowers with good credit history.

- Compare Offers: Having multiple offers from different lenders can give you leverage to negotiate for better terms. Use these offers to your advantage during negotiations.

Approaching Lenders for Negotiations

- Be Confident and Prepared: When approaching lenders, be confident in your knowledge of market rates and your financial situation. This will show lenders that you are a serious and informed borrower.

- Express Your Interest: Clearly communicate your interest in refinancing your auto loan and explain why you are seeking better rates. Lenders are more likely to negotiate with borrowers who are proactive and engaged.

Common Misconceptions About Auto Loan Refinance Rates

When it comes to auto loan refinance rates, there are several common misconceptions that borrowers may have. It’s important to debunk these myths to ensure that individuals can make informed decisions about refinancing their auto loans.

Misconception: Refinancing Always Results in Lower Rates

One common myth is that refinancing always leads to lower interest rates. While this can be true in many cases, it’s not a guarantee. The new rate you qualify for depends on various factors such as your credit score, current financial situation, and market conditions. It’s essential to shop around and compare offers to determine if refinancing will actually lower your rates.

Misconception: Refinancing Extends the Loan Term

Another misconception is that refinancing always extends the loan term. While refinancing can potentially extend the term to reduce monthly payments, borrowers can also choose to refinance for a shorter term to pay off the loan faster. It’s crucial to consider your financial goals and choose a loan term that aligns with your objectives.

Misconception: Refinancing is Too Complicated and Time-Consuming

Some borrowers believe that refinancing is a complex and time-consuming process. While it does involve paperwork and research, many lenders offer streamlined online applications that make the process quicker and more convenient. By understanding the steps involved and working with a reputable lender, refinancing can be a straightforward process.

Future Outlook for Auto Loan Refinance Rates

The future outlook for auto loan refinance rates is influenced by various factors that impact the overall economy and the financial market. It is essential for borrowers to stay informed about potential changes in refinance rates to make well-informed decisions regarding their auto loans.

Factors Influencing Future Refinance Rates

- The Federal Reserve’s interest rate decisions: The Federal Reserve plays a significant role in determining interest rates, which can directly affect auto loan refinance rates. Any changes in the federal funds rate can lead to fluctuations in refinance rates.

- Economic conditions: The state of the economy, including factors such as inflation, unemployment rates, and GDP growth, can impact refinance rates. A strong economy may lead to higher refinance rates, while a weak economy may result in lower rates.

- Market competition: Lenders compete with each other to attract borrowers, which can influence refinance rates. Borrowers may benefit from competitive rates when lenders try to gain market share.

Trends in Refinance Rate Expectations

- Experts predict that auto loan refinance rates may remain relatively low in the near future due to the Federal Reserve’s commitment to keeping interest rates at historic lows to stimulate economic growth.

- Borrowers can expect to see refinancing opportunities with favorable rates, especially if they have a good credit score and financial stability.

- However, unexpected economic events or policy changes can lead to fluctuations in refinance rates, making it essential for borrowers to monitor market trends and consider refinancing when rates are favorable.

Summary

In conclusion, staying informed about auto loan refinance rates today can lead to significant savings and improved financial stability. By comparing offers, considering key factors, and being aware of potential risks, borrowers can make the most of their refinancing options.